Every business owner wants a way to take their company to the next level. But how do you get the funding you need to get there? Navigating the world of outside investors can be challenging. Two options you might encounter are investments from private equity (PE) and venture capital (VC). While they both involve outside investment, they cater to different business stages.

Funding Established Growth vs. Early Potential

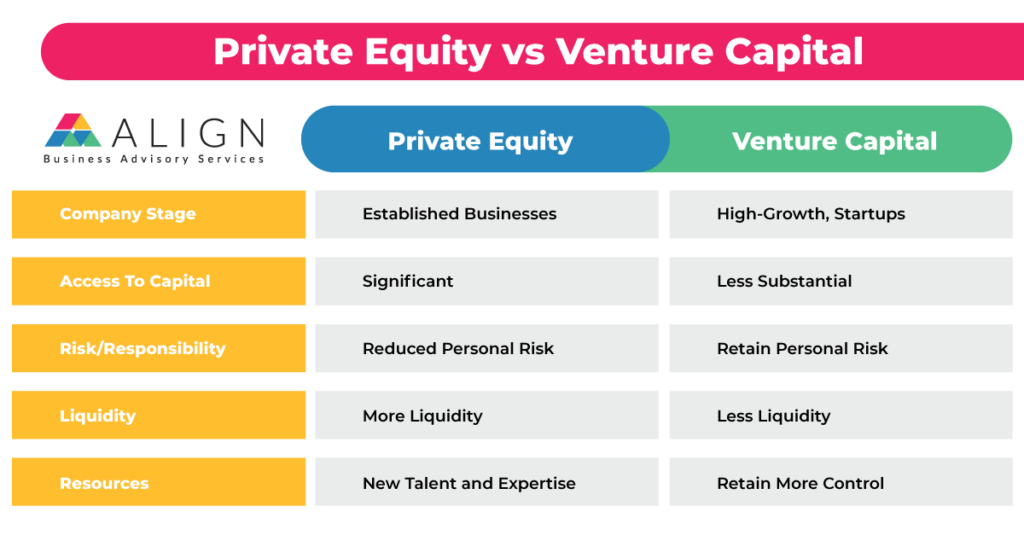

Private equity firms target established businesses, including those in the lower middle market (LMM). Their focus is on operational efficiency and maximizing returns. They bring significant capital to the table, perfect for fueling your strategic initiatives, expansion, or growth. This partnership offers several benefits:

- Shared Expertise and Resources: PE firms bring seasoned investors with valuable experience and connections. This can be a game-changer for LMM businesses seeking guidance and resources.

- Financial Infusion: The capital injection from PE allows for significant growth investments, propelling your company forward.

- Reduced Risk and Increased Liquidity: Existing owners can share some of the financial burden and strategic decision-making with PE firms, mitigating risk and eliminating any personal financial liability. Additionally, selling a portion of your stake can provide partial liquidity while maintaining involvement.

Venture capital, on the other hand, generally focuses on high-growth startups. While these investors can provide capital, it’s typically less substantial than PE and may not support large-scale expansion plans for LMM businesses. Here’s how VC differs from PE for LMM business owners:

- Less Hands-On: Compared to PE, VC investors will provide less guidance and you will maintain full control over day-to-day operations.

- Limited Capital and Control: The funding amount in VC deals might not be enough for your growth ambitions. Additionally, you’ll likely retain most ownership, meaning you shoulder more risk.

- Less Liquidity: Selling a minority stake might be an option, but it provides limited liquidity compared to PE partnerships.

Partnering with PE Experts: The Advantage For LMM Businesses

For owners of established LMM businesses, controlled recapitalization via private equity offers clear advantages in empowering you to execute ambitious expansion plans, tap into valuable resources, and position yourself for sustained, long-term success with the capital and expertise you need. Our team of advisors at Align can connect you with the right PE firms, ensuring a perfect match for your specific needs and goals. Reaching your full growth potential requires the right tools and resources, and we can leverage our expertise to help you navigate the PE process seamlessly and maximize your chances of a successful partnership. We’ll connect you with tailored PE specialists who understand your specific industry and growth goals and who will help you realize what you envision.

Contact us to learn more about your options and how we can help you find the right partner for your needs.