If you’re a business owner in the lower-middle market, there’s very good news in what we’re seeing in the market so far in 2025.

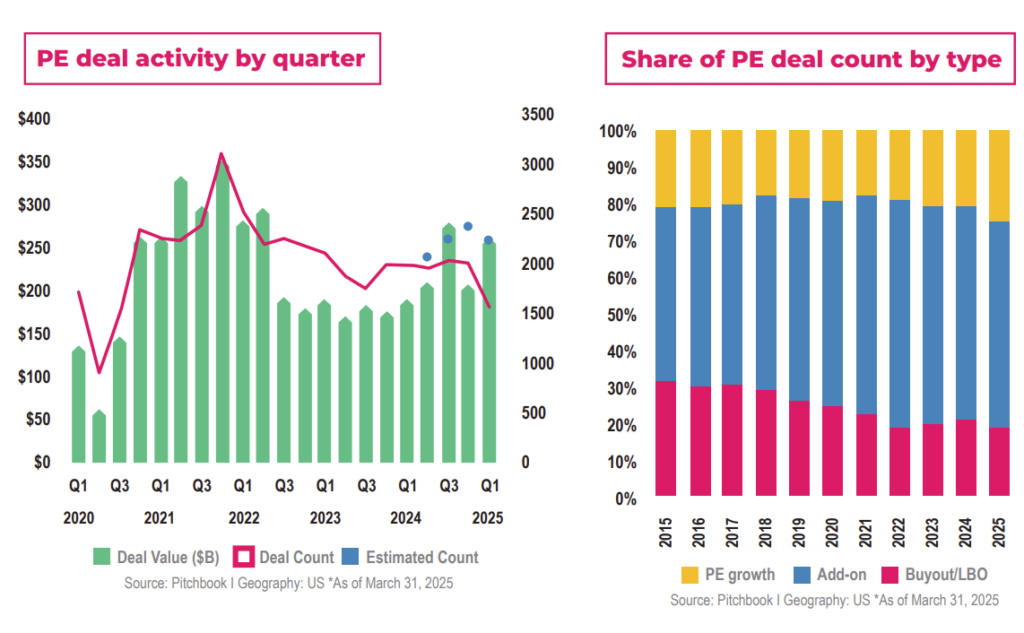

While overall deal value and volume are down from their peaks, they remain well above historical averages from the past decade. And what’s fueling this resilience? A pronounced shift toward smaller transactions – and with it, a growing appetite for the lower-middle market. If you’re considering making a move, this is a trend not to miss. Middle-market fundraising accounted for almost 61% of the total funds raised through Q1 of 2025.

The Rise of the Add-On

As larger platform buyouts become harder to finance due to elevated interest rates, PE firms are leaning into buy-and-build strategies. In Q1 2025, over 74% of PE deals were add-ons or growth deals. This is a clear signal that firms are putting their dry powder to work by expanding their existing portfolio companies through bolt-on acquisitions.

This isn’t just tactical, it’s smart. Add-ons are typically easier to underwrite, involve less valuation misalignment, and are more nimble in volatile markets. In a fragmented sector, the ability to scale through acquisition is a winning formula.

Why Lower-Middle Market Businesses Are in Demand

This hyper-fragmentation creates opportunities for consolidation, and buyers are circling. Especially in verticals like HVAC, plumbing, specialty manufacturing, and B2B services—where there’s repeatable revenue, local or regional dominance, and operational upside—PE funds see major potential.

And yet, one of the most persistent myths we hear from founders is that “it’s a bad time to sell.” The opposite is often true.

When public markets are uncertain, private equity looks down-market for opportunity. It’s simpler to structure, more affordable to finance, and aligns perfectly with strategies designed to ride out economic turbulence while building toward a bigger exit down the line.

Is Now the Right Time for You?

If you’re nearing retirement, you may not want, or be able to, wait out the next cycle. The good news is that demand for your business is strong now. If you’ve got a longer runway, this may be your moment to scale with a partner and create even more generational wealth.

At Align, we specialize in helping businesses in navigating these opportunities. We know the market, the players, and how to help business owners take advantage of today’s trends.

Curious where your business fits?

Contact us to request the full Q1 2025 Private Equity Market Report and explore what this market shift could mean for your exit or growth strategy.